What Would Trumps Tax Cut Do for Major Corporations?

In what is being called a “tax cut for the rich” President Donald Trump has proposed that corporate tax rate be cut to 15% instead of 35% and the repatriation rate be cut to a “one time” 10% from its previous 35%. Trump and many of his cabinet members can all gain from this cut.

Meanwhile, the plan slashed at tax deductions, creating a bigger potential burden on residents of high tax states and notable excluded any taxes on imported goods- a plan which would have offset corporations moving oversees. The plan will also create a larger national debt and leave the budget shot several trillion in previous corporate tax dollars.

This cut is projected to be beneficial for major corporations and business owners. The cut is aimed to allow for growth of major corporations like Fortune 500 Companies.

The idea is that the cut will allow the companies to hire more employees. In addition to reducing corporate taxes, Trump wants to apply the same break to business owners- who would usually be in a higher tax bracket. Business owners pay both corporate and personal taxes.

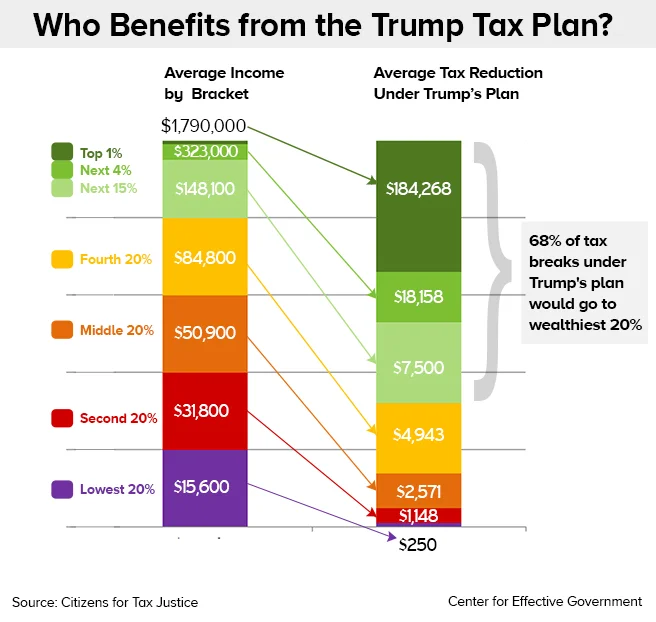

While the plan might benefit small business owners and independent contractors, it will definitely benefit those who are already wealthy.

Experts are speculating that the cuts will help large businesses and corporations, but may result in salaried employees switching to “independent contractor” status to avoid paying taxes. Fortune 500 Companies and wealthy business owners, including Trump himself and most of his cabinet, stand to benefit the most from the cuts, which will need to be approved by Congress.